Georgia payroll calculator 2023

Get Started With ADP Payroll. Figure out your filing status work out your adjusted gross income.

2023 Hyundai Kona Review Ratings Specs Prices And Photos The Car Connection

Employers can enter an.

. Calculating your Georgia state. 2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB. Prepare and e-File your.

Employers also have to pay a matching 62 tax up to the wage limit. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Discover ADP Payroll Benefits Insurance Time Talent HR More. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Medicare tax which is 145 of each employees taxable wages up to 200000 for the year.

Free Unbiased Reviews Top Picks. Georgia Payroll Calculator Tax Rates Use our easy payroll tax calculator to quickly run payroll in Georgia or look up 2021 state tax. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Get Started With ADP Payroll. It will be updated with 2023 tax year data as soon the data is available from the IRS. So the tax year 2022 will start from July 01 2021 to June 30 2022.

If you have employees in Illinois you must be sure to take payroll taxes. Free Georgia Payroll Tax Calculator and GA Tax Rates. Georgia Salary Paycheck Calculator.

Prepare and e-File your. Temporary Salary Supplement 195 KB Microsoft Word Document 85 KB. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. All Services Backed by Tax Guarantee. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Georgia Payroll Tax Rates.

Outlook for the 2023 Georgia income tax rate. Living Wage Calculation for Georgia. Outlook for the 2023 Georgia income tax rate is to.

Ad Process Payroll Faster Easier With ADP Payroll. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators. Ad Process Payroll Faster Easier With ADP Payroll.

Ad Payroll So Easy You Can Set It Up Run It Yourself. This guide is used to explain the guidelines for Withholding Taxes. Free Unbiased Reviews Top Picks.

For 2022 the minimum wage in Georgia is 725 per hour. Georgia tax year runs from July 01 the year before to June 30 the current year. Georgia Paycheck Calculator - SmartAsset SmartAssets Georgia paycheck calculator shows your hourly and salary income after federal state and local taxes.

Using an Illinois paycheck calculator will help you figure out your take-home pay. EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Enter your info to see your. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Ad Compare This Years Top 5 Free Payroll Software.

Temporary Salary Supplement - One year status check 81 KB Microsoft Word Document 85 KB. On the other hand if you make more than 200000 annually you will. The assumption is the sole.

Ad Compare This Years Top 5 Free Payroll Software.

2023 Toyota 4runner Mid Size Suv Toyota Canada

Georgia State University Holidays 2020 Georgia State University Georgia State State University

2023 Kia Sportage Review Ratings Specs Prices And Photos The Car Connection

Home Dfi

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

Federal Register Medicare Program Prospective Payment System And Consolidated Billing For Skilled Nursing Facilities Updates To The Quality Reporting Program And Value Based Purchasing Program For Federal Fiscal Year 2023 Changes To

State Corporate Income Tax Rates And Brackets Tax Foundation

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Qualified Invoice System For Consumption Tax Purposes To Be Introduced In 2023 Services Business Tax Deloitte Japan

Tax Office Services

2023 College Football Championship Odds Track Ncaaf Favorites

Calculator And Estimator For 2023 Returns W 4 During 2022

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Math Tutorials Salary

2023 Ford F 650 F 750 Commercial Truck Gas Or Turbo Diesel 3 Cab Configurations

Cola 2023 Prediction Next Year Adjustment Already Stands At 3 9 Marca

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

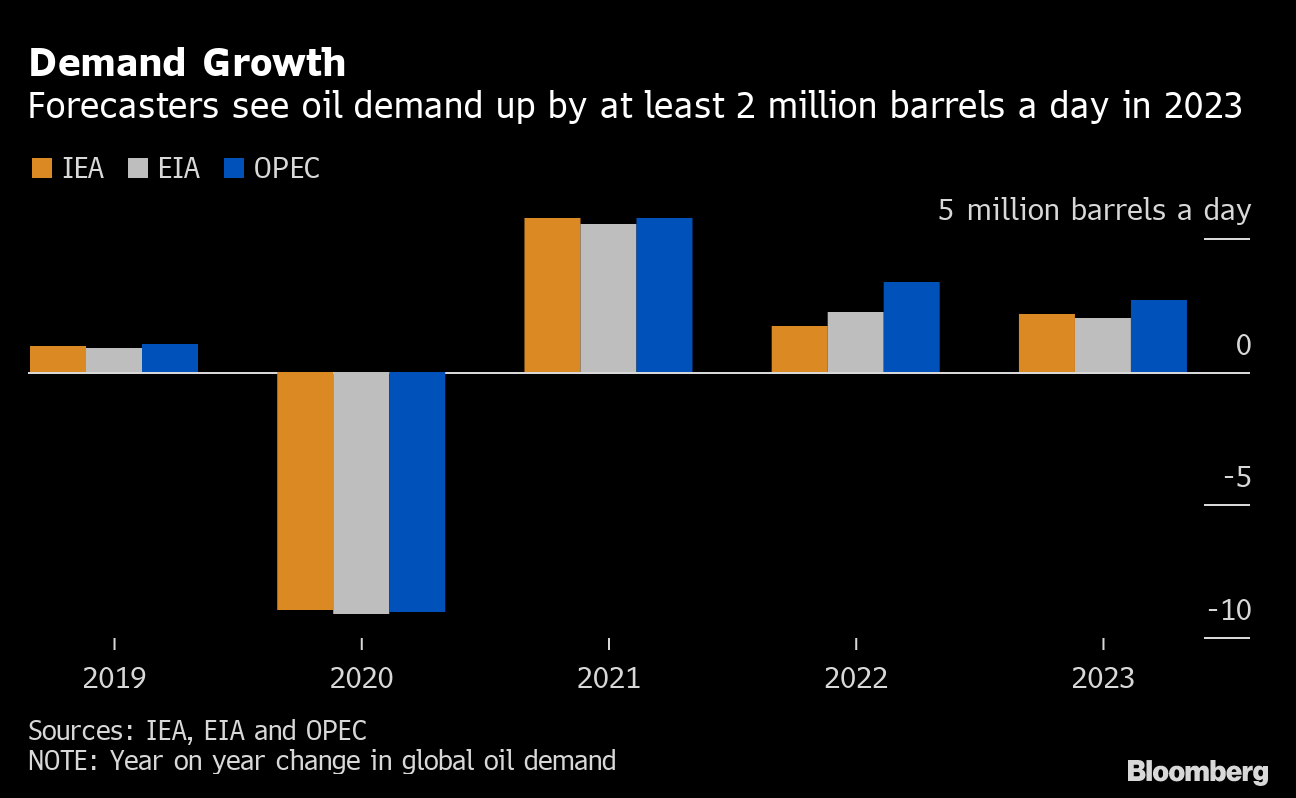

Opec Faces A Near Impossible Oil Production Task In 2023 Bloomberg